Emergency Financial Aid for Students: Where to Turn When You Need Fast Support

Anúncios

Unexpected challenges can disrupt academic journeys. For learners balancing studies with limited resources, sudden crises like family income loss or medical bills often create impossible choices. Over 90% of UNCF scholarship recipients require financial assistance during their studies, highlighting how common these hurdles are.

Programs offering rapid support have proven transformative. Since 2009, institutions like UNCF have distributed $30 million to over 13,000 individuals facing urgent needs. These initiatives prioritize academic commitment, focusing on those maintaining grades despite temporary setbacks.

Available resources include grants and short-term loans designed for one-time crises. Unlike standard aid packages, they address immediate gaps—such as housing insecurity or transportation costs—that might otherwise force withdrawals. Timely intervention keeps educational goals within reach.

Understanding this system’s structure is vital. Most programs require proof of hardship and a clear plan for academic continuity. By offering targeted relief, they preserve years of effort and investment in higher education.

Understanding Student Emergency Financial Help

Academic pursuits often face sudden roadblocks that demand immediate attention. These critical moments require swift solutions to prevent derailing educational progress. Support systems exist specifically to address time-sensitive crises impacting learners’ stability.

Defining Financial Emergencies for Learners

Urgent monetary needs arise from unpredictable events threatening academic continuity. Common triggers include:

- Sudden income loss affecting tuition payments

- Medical crises requiring immediate treatment costs

- Essential housing or transportation disruptions

One university administrator notes: “We prioritize cases where temporary assistance can prevent long-term setbacks.” Eligibility typically requires proof of enrollment and documented hardship.

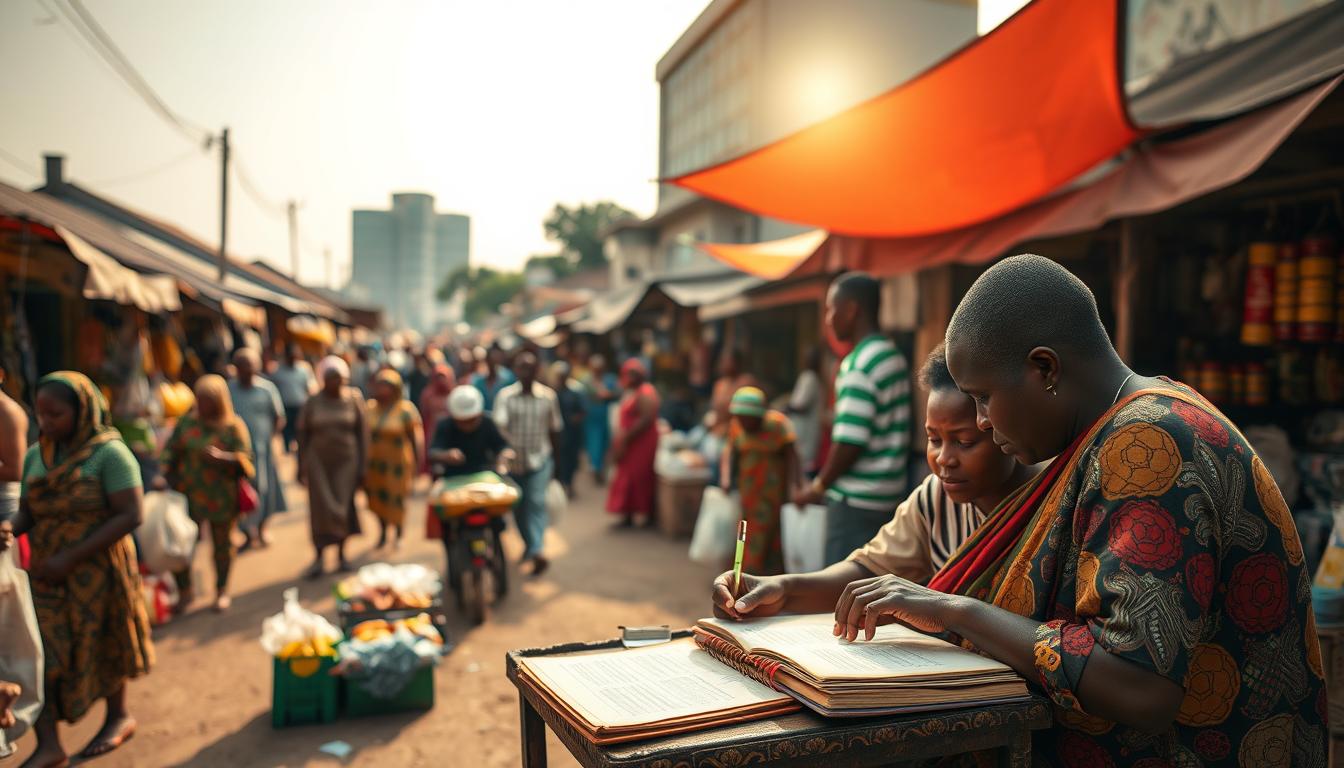

Challenges Faced by Nigerian Learners in Urgent Situations

Geographic and economic factors create unique obstacles. Currency exchange volatility often reduces the value of family remittances overnight. Limited digital banking infrastructure complicates fund transfers during crises.

Cultural expectations about self-reliance sometimes delay assistance requests until situations become critical. Recent surveys show 68% of Nigerian undergraduates hesitate to disclose monetary struggles until facing eviction or academic probation.

Exploring Financial Assistance Options and Resources

When crises strike, knowing where to find support makes all the difference. Educational institutions and organizations provide structured solutions to address pressing needs while maintaining academic progress.

Overview of Grants, Loans, and Direct Funding

Multiple pathways exist for addressing urgent monetary gaps. Degree completion grants at institutions like UNCF offer up to $2,500 to remove final-semester barriers. “These funds often determine whether someone walks across the graduation stage,” explains a program coordinator. Short-term, interest-free loans under $500 help bridge timing gaps between aid disbursements and bill deadlines.

Programs Covering Housing, Food, and Medical Needs

Basic living expenses account for 78% of urgent funding requests nationwide. Housing insecurity payments prevent evictions by covering rent or utilities directly. Food grants provide meal credits through campus dining services, while medical assistance addresses unexpected treatment costs. Washington State University allocates $1,000 annually per applicant for these critical needs.

Disbursement Methods and Reporting Timelines

Speed matters when resolving crises. Most universities process direct deposits within 5 business days after approval. Documentation requirements include recent eviction warnings or medical bills. Ohio University’s microgrants demonstrate efficiency—eligible applicants receive $500 within 72 hours for verified emergencies.

Navigating the Application Process and Eligibility Criteria

Securing urgent academic support requires understanding specific procedures. Institutions prioritize applicants who demonstrate both need and commitment to completing their education. This section clarifies key steps and requirements for accessing critical resources.

Step-by-Step Guide to Applying for Funds

Begin by obtaining the Emergency Funding Request form from your institution’s financial aid portal. Complete these essential steps:

- Detail the nature of your crisis and required assistance amount

- Attach supporting documents dated within the past month

- Submit to both Student Financial Services and academic advisors

One advisor notes: “Applications with precise timelines and clear academic plans receive faster approvals.”

Eligibility Requirements and Documentation Needed

Approval depends on meeting three core criteria:

| Requirement | Documentation | Timeline |

|---|---|---|

| Active enrollment (3+ credits) | Class schedule | Current term |

| Financial need verification | FAFSA/WAFSA records | 30 days prior |

| Resource exhaustion proof | Loan/work-study denials | Submitted with application |

Processing takes 5-10 business days for complete submissions. Funds only disburse during active enrollment periods—requests between semesters typically get denied. Always consult advisors before applying to confirm eligibility.

Conclusion

Timely interventions can make or break academic aspirations. Donor-funded initiatives demonstrate how strategic resources preserve educational momentum during crises. These programs—fueled by alumni and community contributions—transform short-term gaps into long-term success stories without repayment burdens.

Effective use requires understanding available options early. Many learners find grants ideal for housing issues, while interest-free loans address timing gaps between aid cycles. Documenting needs and maintaining communication with advisors accelerates approvals when urgency strikes.

Successful outcomes depend on viewing these funding sources as complementary tools rather than permanent solutions. Institutions increasingly recognize that supporting learners through temporary hardship benefits entire communities by retaining talent and knowledge.

As programs evolve, streamlined access and expanded eligibility will remain crucial. Continued donor commitment ensures future learners can focus on growth rather than survival—keeping academic dreams achievable despite life’s unpredictable challenges.

FAQ

What situations qualify for urgent funding support?

How quickly can applicants receive approved funds?

Are international learners eligible for these programs?

What documents prove eligibility during applications?

Can awards affect existing scholarships or loans?

Do repayment obligations apply to all types of aid?

Published on: 21 de July de 2025

Sofia Kamara

Sofia Kamara is the founder of GoldenCred.blog, a platform built to guide students and young professionals in navigating international opportunities. With a background in public policy and international relations, Sofia has spent years helping people secure scholarships, sponsorship visas, and financial planning strategies for studying abroad.

She believes that accessible, accurate information is a powerful tool for change. Her writing combines practical advice with strategic insights, crafted especially for those eager to take bold steps toward education and career development in countries around the world.